The latest statistics from the London Court of International Arbitration (LCIA) and the International Chamber of Commerce (ICC) provide valuable insights into evolving trends in global dispute resolution. Both institutions continue to reflect the internationalisation of arbitration, growing involvement from emerging markets, increased attention to tribunal composition, and greater procedural efficiency in handling complex, high-value disputes.

LCIA Arbitration Statistics 2024

Caseload and International Reach

During 2024, the LCIA received 362 new referrals,[1] a slight decrease from 377 referrals in 2023.[2] However, this tendency is consistent with post-COVID trends.

The LCIA’s caseload continued to be predominantly international, with 95% of arbitrations including at least one international party and 75% involving exclusively international parties. Its global profile is confirmed by the fact that parties originated from 101 different jurisdictions (including 85% of parties from jurisdictions other than the UK).[3]

Additionally, LCIA arbitrations were seated in 21 cities across 15 jurisdictions, applying 35 different substantive laws. As expected, London remained dominant, chosen as the seat in 89% of cases, while the law of England and Wales governed 78% of arbitrations.[4]

State and Emerging Market Participation

Notably, 14% of LCIA cases involved States or State-owned entities.[5] This is a record high, and a tendency in growth in these appointments can be seen.[6]

Another noteworthy increase is a sharp rise in parties from Africa, now comprising 17% of all participants compared to 8% in 2023. Kenya alone accounted for 7.7%, making it the first nationality to follow the UK.[7]

On the other hand, declines were noted among parties from Western Europe (18% in 2024 compared to 21% in 2023) and the MENA region (a decrease from 16% to 11%).[8]

Sectoral Developments

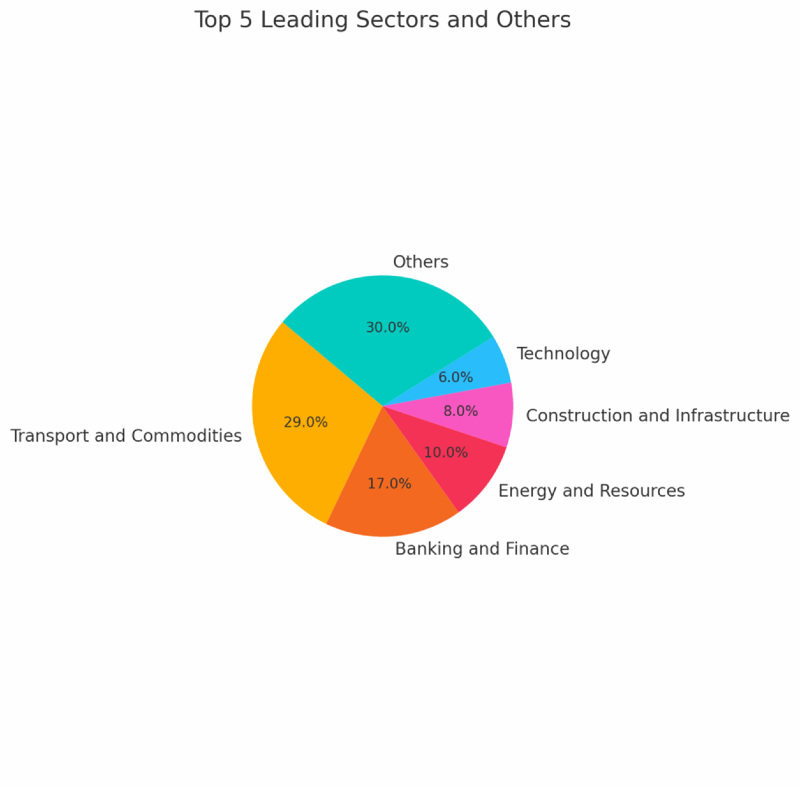

Regarding the dominant industry sectors, transport and commodities remain prominent, although their share fell to 29% compared to 36% year before.[9] Disputes in banking and finance grew to 17%, while those in energy and resources decreased to 10%, although remaining the second and third largest sectors. [10]

Additionally, construction and infrastructure and technology disputes are represented with 8% and 6% respectively.[11]

Tribunal Composition and Diversity

Although three-member tribunals remain dominant with 54%, since 2023, there has been a notable tendency towards an increase in sole arbitrators and a decrease in three-member tribunals.[12]

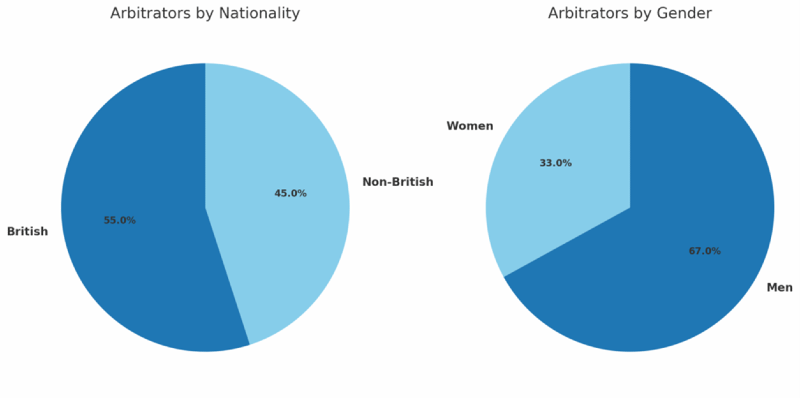

While 55% of arbitrators were British nationals, 59% of LCIA Court appointments were non-British.[13] This demonstrates that the LCIA tends each year to appoint more and more non-British nationals.

Additionally, gender diversity remains a focus. In 2024, 33% of all arbitrators were women, including LCIA’s appointments (45% women), as well as 21% appointments by parties.[14] However, it should be noted that this represents a slight decrease from 48% in 2023 to 45% in 2024.

Although there were 15 applications for expedited formation of the tribunal in the last year, only one was granted.[15]

ICC Arbitration Statistics 2024

Caseload and Internationality

Last year alone, the ICC handled 841 new cases (831 under ICC Rules), with 1,789 cases pending at year-end, amounting to a record USD 354 billion in total dispute value.[16]

2,392 new parties came from 136 different jurisdictions, with cross-border disputes making up 69% of the caseload. In addition, the ICC International Centre for Amicable Dispute Resolution received a total of 61 new referrals.[17]

In 2024, arbitral proceedings took place in 107 cities spanning 62 countries and territories. The most frequently selected seats included the United Kingdom, France, Switzerland, the United States, and, notably for the first time, the United Arab Emirates, highlighting evolving trends in the global distribution of arbitration venues.[18] The most chosen arbitration seats remain London, Paris, Geneva and New York.[19]

State Participation

In 2024, 45 states and 143 state-owned entities were parties in 159 cases, making up 19% of new filings. This represents an increase from 16% involving such parties in 2023.

Regarding parties, the ten countries where parties most frequently originated were the USA, Brazil, Spain, Mexico, Italy, the People’s Republic of China (including Hong Kong), Germany, Türkiye, France, and the UAE.

It should be noted that the States from Africa, the Middle East, Latin America, and Central Asia were more visibly involved, especially in disputes related to infrastructure, energy, and extractive industries.

Sector Highlights

Construction/engineering and energy sectors disputes comprised 44% of the caseload, with 23.2% and 20.5% respectively. Other sectors highly represented include transport, financing and insurance, telecommunications, and health, pharmaceuticals and cosmetics. [20]

Tribunal Composition and Procedural Developments

Despite ongoing diversity efforts, men comprised 71.4% of the appointed arbitrators. In contrast, 46% (181) of all ICC Court appointments were women, up from 41% in 2023. It should be noted that the proportion of women acting as sole arbitrators or presidents increased to 43% from 36% respectively, and 20% of co-arbitrators confirmed or appointed were women.[21]

In 2024, 17 Emergency Arbitrator applications were filed: 3 requests were fully granted, 2 partially granted, and 12 dismissed.[22]

Article 30 and Appendix VI of the ICC Arbitration Rules set forth an expedited procedure designed to facilitate cost-effective arbitration, with a final award rendered within six months. Last year, ICC administered 152 such new cases, which included 147 automatic applications and five opt-ins.[23]

Comparison

In terms of caseload and global reach, the ICC continues to dominate in volume and scale, as well as the total pending caseload valued at an unprecedented USD 354 billion. While the ICC operates across a broader geographic and economic spectrum, the LCIA maintains a strong international profile as well, with 95% of its cases involving at least one international party and parties hailing from 101 different jurisdictions. For the ICC, traditional arbitration hubs such as London, Paris, Geneva, and New York remained dominant, with the inclusion of the UAE as well. However, for the LCIA, London remained the most popular choice.

Participation from states and emerging markets rose in both institutions. While the LCIA saw a significant increase in participation from African parties, the ICC highlighted visible engagement from the Middle East, Latin America, and Asia.

In terms of sectoral representation, both institutions reflected similar priorities but with different weightings. The ICC’s caseload was dominated by disputes in the construction/engineering and energy sectors. On the other hand, the LCIA demonstrates transport and commodities disputes as prominent, followed by banking and finance disputes.

Finally, both institutions strive to make diversity efforts a priority, with an increasing number of women appointed as arbitrators.

Conclusion

The latest arbitration statistics from both the LCIA and the ICC underscore global trends in dispute resolution, including the growing internationalisation of arbitration, increasing participation from states and emerging markets, and heightened attention to diversity and procedural efficiency.

For clients facing cross-border disputes, the choice of an arbitral institution is an important question. Both the LCIA and ICC offer robust, globally respected frameworks, with notable differences in cost structures, tribunal appointment practices, and administrative support. The ICC maintains a larger and broader global presence with extensive infrastructure and sector-related cases, while the LCIA continues to demonstrate steady international relevance.

[1] LCIA 2024 Annual Casework Report, p. 5.

[2] LCIA 2023 Annual Casework Report, p. 3.

[3] LCIA 2024 Annual Casework Report, p. 5.

[4] Ibid.

[5] Ibid.

[6] LCIA 2023 Annual Casework Report, p. 3. See also https://www.lcia.org/lcia/reports.aspx.

[7] LCIA 2024 Annual Casework Report, pp. 13-14.

[8] LCIA 2024 Annual Casework Report, pp. 13-14.

[9] LCIA 2024 Annual Casework Report, pp. 9-10.

[10] Ibid.

[11] Ibid.

[12] LCIA 2024 Annual Casework Report, p. 18.

[13] LCIA 2024 Annual Casework Report, p. 20.

[14] LCIA 2024 Annual Casework Report, p. 21.

[15] LCIA 2024 Annual Casework Report, p. 24.

[16] ICC Dispute Resolution 2024 Statistics, pp. 4-5.

[17] ICC Dispute Resolution 2024 Statistics, p. 18.

[18] ICC Dispute Resolution 2024 Statistics, p. 12.

[19] ICC Dispute Resolution 2024 Statistics, p. 28 (Table 10).

[20] ICC Dispute Resolution 2024 Statistics, p. 5.

[21] ICC Dispute Resolution 2024 Statistics, p. 11.

[22] ICC Dispute Resolution 2024 Statistics, p. 16.

[23] ICC Dispute Resolution 2024 Statistics, p. 6.