Investment treaty arbitration has various flaws, but one flaw that is acknowledged by both foreign investors and States who use the dispute resolution system is that, in practice, it can be incredibly expensive.

The costs of investment treaty arbitration can be unbearable for certain States, who have far better uses for public funds, and they can also be unbearable for many foreign investors whose rights were, at times, egregiously violated, but who cannot pay to seek redress.

There are, however, ways to significantly reduce the cost of investment arbitration, for both foreign investors and States, which are reviewed below.

The four main heads of cost for investment treaty arbitration will be examined below. These heads of cost include: (1) arbitrator fees and institutional administrative expenses, (2) legal fees and expenses, (3) expert costs and (4) hearing and witness costs.

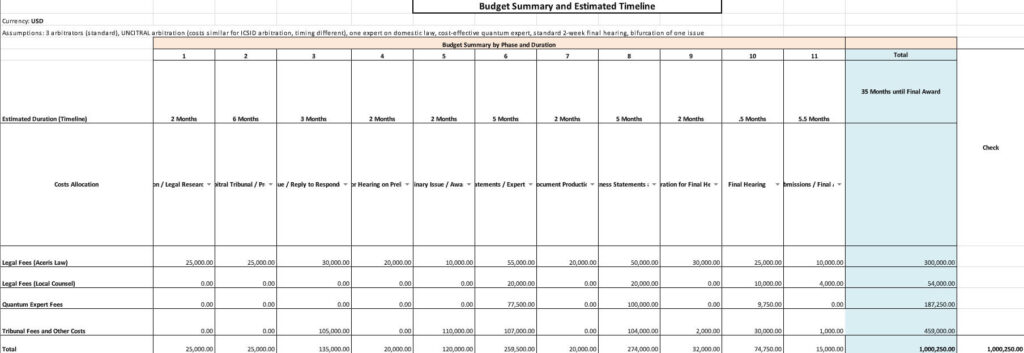

It is possible for the cost of investment treaty arbitration per party not to exceed USD 1 million, although USD 1 million does represent the floor for most ICSID arbitrations, due to the high costs of ICSID arbitral tribunals.

Arbitrator Fees and Institutional Administrative Expenses

Arbitrator Fees and Institutional Administrative Expenses

The sine qua non for an investment treaty arbitration proceeding is to have an arbitral tribunal in place who will rule on the dispute. If the arbitrators’ fees are not paid, there will be no arbitral tribunal and, hence, no final ruling. State representatives have realised that some foreign investors cannot or are unwilling to pay arbitrators’ fees thus, rather than wasting time and attempting to settle a dispute after receiving a Notice of Arbitration, they force the foreign investor to instead pay the required advance on costs needed to constitute an arbitral tribunal prior to spending significant time or resources.

Arbitrator fees and institutional administrative expenses can be very expensive for investment treaty arbitrations, for both foreign investors and for States, especially for arbitrations under the ICSID Arbitration Rules.

Arbitrator Fees under the ICSID Arbitration Rules

At the ICSID, the Schedule of Fees (the latest of which dates from 1 January 2019) provides that arbitrators are entitled to receive a fee of USD 3,000 per day of meetings or other work performed in connection with the proceedings, as well as subsistence allowances and reimbursement of travel expenses. This is generous and the result is that, according to one study, average ICSID arbitral tribunal costs were USD 882,668.19 with a median of USD 875,907.97. As both parties to the dispute are expected to pay half of these fees, both the foreign investor and the State should expect to pay approximately USD 440,000 each for the fees of the arbitral tribunal, should they wish to pursue an ICSID arbitration through to its end.

The ICSID will also levy a fee for lodging requests of USD 25,000, will levy an administrative charge of USD 42,000 upon the registration of a request for arbitration, and it will continue to levy an administrative charge of USD 42,000 thereafter on an annual basis. Ultimately, ICSID arbitration can be expensive, for both foreign investors and for States, prior to the consideration of legal fees.

Arbitrator Fees under the UNCITRAL Arbitration Rules

For ad hoc UNCITRAL arbitrations, the situation is different, as there is no schedule of arbitrator fees under the UNCITRAL Arbitration Rules. Guidance on arbitrator fees is found in Article 41 of the UNCITRAL Arbitration Rules, which merely states, “The fees and expenses of the arbitrators shall be reasonable in amount, taking into account the amount in dispute, the complexity of the subject matter, the time spent by the arbitrators and any other relevant circumstances of the case.”

In practice, while arbitrator fees can be discussed with the arbitral tribunal, they are frequently set with reference to the fees of other arbitral institutions, such as the ICSID, for investment treaty arbitrations. One study showed that average UNCITRAL tribunal costs for investment treaty arbitrations were on par with those of the ICSID, at between USD 853,000 to USD 1,089,000 overall (or USD 426,500 to USD 544,500 per party).

While it is possible for the parties to discuss arbitrator fees in UNCITRAL arbitrations with the arbitrators, ultimately, public data suggests that there is not a significant difference between the ICSID and arbitrations under the UNCITRAL Arbitration Rules in terms of arbitral tribunal costs for investment treaty arbitrations.

Arbitrator Fees under the ICC Rules of Arbitration and the SCC Arbitration Rules

Certain bilateral investment treaties allow investor treaty arbitrations to be brought under specific institutional rules, such as the ICC Rules of Arbitration or the SCC Arbitration Rules. For smaller claims, this can reduce the costs of investment treaty arbitration dramatically, as arbitrator fees under the ICC Rules of Arbitration and the SCC Arbitration Rules are based on the amount in dispute, rather than being paid on a daily basis.

For instance, whereas arbitrator fees would be expected to be USD 440,000 per party before an ICSID arbitral tribunal for a USD 10 million expropriation claim, overall fees per party (including both arbitrator fees and ICC administrative expenses) would be expected to be only USD 200,000 per party (half of USD 397,367) for an investment treaty arbitration being conducted under the Rules of Arbitration of the ICC. This is less than half the cost of average ICSID arbitrator fees.

Thus, except for the largest claims, the ICC Rules of Arbitration or the SCC Arbitration Rules should be considered, when this is an option under the relevant treaty.

Legal Fees and Expenses

According to the Permanent Court of Arbitration, “[I]n the PCA’s experience, counsel and expert fees can account for 90% of the cost, while tribunal and institutional fees can account for the remaining 10%.”

A foreign investor or State has little control over the fees of the investment treaty arbitration arbitral tribunal, except in those circumstances when investment treaty arbitration is available under specific institutional rules. It does, however, have a significant degree of control over the legal fees it will pay for representation in an investment treaty arbitration, as these fees vary wildly depending on the law firm that is selected.

Data suggests that, on average, claimants paid party costs (fees and expenses of counsel, experts and witnesses) of USD 6,019.000 per arbitration, whereas respondents paid party costs of USD 4,855,000. While these costs include expert fees, discussed below, many millions of USD of legal fees are typical paid to lawyers in investment treaty arbitrations. If fees are billed on an hourly basis, legal fees for foreign investors or States will always be expensive for investment treaty arbitrations. Most investment treaty arbitrations will require over 5,000 hours of legal work. Assuming a blended rate of USD 350/hour, which is not particularly high, this represents USD 1,750,000 in legal fees per arbitration.

For very large cases, such as Hulley Enterprises Limited (Cyprus) v. The Russian Federation, UNCITRAL, PCA Case No. AA 226, in the jurisdiction phase, Claimant’s counsel performed 52,076.90 hours of legal work, for attorney fees of USD 23,018,168.50; in the merits phase, Claimant’s counsel performed 70,525.90 hours of work, for legal fees of USD 39,931,981.50. This works out to an effective hourly rate of USD 513/hour for the full arbitration, which is high but no higher than the fees charged by many large corporate firms. Payment of USD 40 million in legal fees for an arbitration may be justified when the amount in dispute is very large, as was the case in Hulley Enterprises Limited (Cyprus) v. The Russian Federation, but most foreign investors and States will be uncomfortable paying such amounts.

While it may be more comfortable for in-house counsel at a large corporation or the legal representatives of a State to use a large corporate firm, on the basis that that they cannot be blamed if a case fails as they paid a premium for legal representation, there is no data to show that case outcomes vary significantly on the basis of the law firm that is selected. Ultimately, it depends on the intelligence and rigour of the individual lawyers who are working on a case, the facts of the case itself and the arbitral tribunal that is selected (different arbitrators will, frustratingly, rule very differently in investment treaty arbitrations given an identical fact pattern or treaty provision, so selecting appropriate arbitrators is of paramount importance).

It suffices to say that some arbitration boutique law firms will charge far less in legal fees than large corporate firms for investment treaty arbitrations. Aceris Law, for instance, caps its legal fees per investor-State arbitration, while including a small success fee element when representing claimants and a small uplift element when representing respondents. These fees are highly competitive and designed to ensure that profit is made for the firm only if the objectives of the client, which typically involves receiving compensation or avoiding the payment of compensation, are in fact met.

While legal expenses are typically minor in comparison to legal fees (including the costs of printing, photocopies, phone calls, translations and travel), they cannot always be ignored. In Hulley Enterprises Limited (Cyprus) v. The Russian Federation dispute, expenses of USD 5.3 million were incurred, for instance, although again the dispute was particularly large. While a minor cost element, typically representing less than 5% of legal fees, such expenses should not be entirely ignored by foreign investors or States.

Expert Costs – Quantum Experts and Legal Experts

Like legal fees, the costs charged by individual experts will vary wildly in investment treaty arbitrations, with better-established firms like NERA, FTI, Navigant or the Brattle Group charging premiums as compared to other economic consultants.

Frequently, it is necessary to appoint a quantum expert in order to quantify damages, such as to determine the fair market value of an investment at the time of its expropriation. Such costs will vary depending on the expert who is selected and the fees that are negotiated, ranging from USD 150,000 to USD 500,000 per arbitration, or more. For instance, Navigant charged USD 7,370,493.22 in the Hulley Enterprises Limited (Cyprus) arbitration, which was exceptional. At times, quantum experts in lower cost jurisdictions may be used, if one knows where to find them. It is safe, however, to assume minimum costs of USD 150,000 when a quantum expert is needed in an investment treaty arbitration.

Legal experts may also be needed, if there is an issue of domestic law that must be considered in the investment treaty arbitration. While the cost of legal experts will again vary wildly, depending on the jurisdiction in question and the individual legal expert, these costs tend to be far lower than the costs of quantum experts. For instance, one legal expert was paid USD 70,000 in the Hulley Enterprises Limited (Cyprus) arbitration, and another legal expert was paid GBP 69,500. In our experience, expert fees and expenses rarely exceed USD 50,000.

Hearing Costs and Witness Costs

The final cost element that must be considered for investment treaty arbitrations is hearing costs and witness costs, as there will be one or more hearings over the course of an investment treaty arbitration that is not settled amicably.

These costs include the cost for hearing rooms (World Bank room rentals are included in the ICSID’s administrative fee in cases administered by the ICSID), but they are not generally included for UNCITRAL, ICC or SCC arbitrations. These costs are low in comparison to other arbitration costs, for instance EUR 3,000 per day for the Bosphorus room at the ICC in Paris, which is paid in half by both parties.

A court reporter is also required, who will typically charge less than USD 2,000 per day for same-day transcription services.

As for witnesses, who are not allowed to be paid, primary costs include reimbursement of lodging and travel expenses, and at times the payment of per diem when this justified. Such costs tend to be low, and a small fraction of the overall cost of an investment treaty arbitration.

A translator may also be required for the hearing, depending on the language in which testimony will be given.

Conclusion Regarding Investment Treaty Arbitration Costs

In conclusion, it should be possible for foreign investors and States to spend no more than USD 1 million either prosecuting or defending an ICSID arbitration. However, USD 1 million does likely represent the floor for the cost of an ICSID arbitration, and costs may be significantly greater depending on the law firm that is representing the State or foreign investor.

While arbitrator fees cannot be avoided, or the case will not be heard, these may be reduced if ICC arbitration or SCC arbitration are available under the relevant treaty instrument.

Foreign investors and States do have full control over the cost of legal fees, which are by far the largest single cost element. They have no one but themselves to blame if they decide to spend an inordinate amount on legal fees, as many high-quality alternatives to large corporate law firms exist today.

While costs often follow the event in investment treaty arbitration, and may be awarded to the winning party, it may take many years in order to recuperate the costs of an investment arbitration from the losing party, if this is indeed possible, due to the issue of judgment proof claimants in investment arbitration (of concern to States) and the difficulty of enforcing awards against States (of concern to foreign investors, due to sovereign immunity).

Structuring an investment treaty arbitration in a cost-effective manner is, however, entirely possible today, and almost always in the interests of users of investment treaty arbitration.