International arbitration and Greek sovereign debt make uncomfortable bedfellows according to one Arbitral Tribunal in the case Poštová banka, a.s. and ISTROKAPITAL SE v. Hellenic Republic.[1]

International arbitration and Greek sovereign debt make uncomfortable bedfellows according to one Arbitral Tribunal in the case Poštová banka, a.s. and ISTROKAPITAL SE v. Hellenic Republic.[1]

In 2015, an Arbitral Tribunal was tasked to decide on the legality of the Private Sector Involvement Agreement, which was challenged by foreign Greek Government Bond owners, in an International Centre for the Settlement of Investment Disputes (ICSID) Investment Arbitration.

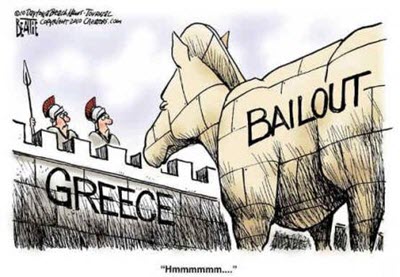

The Private Sector Involvement Agreement refers to the 2012 ‘haircut’ of Greek Government Bonds owned by private individuals, which resulted in a substantial loss of their value, in the context of the ‘bailout’ packages received by the IMF and the EU by Greece in response to its economic downfall.

The dispute raised many interesting questions in the context of the Greek sovereign debt crisis, but the Arbitral Tribunal ultimately declined to rule on the merits, finding it had no jurisdiction to hear the case.

The most crucial aspect of the award was the refusal of the Tribunal to find jurisdiction ratione materiae under the applicable international instruments, which were the Greece-Slovakia BIT and the ICSID Convention.

In particular, it found that Greek Government Bonds do not qualify as protected investments.

According to Article 1 of the Greece-Slovakia BIT, the term “investment” includes:

“. . . (b) shares in and stock and debentures of a company and other form of participation in a company,

(c) loans, claims to money or to any performance under contract having a financial value”.

Relying on standard principles of treaty interpretation, the tribunal found that, even though the BIT provided a fairly broad definition of investment, the parties did not intend for it to include every type of asset.[2]

First, it drew a distinction between participating in a company’s bonds and owning sovereign bonds, thus declining to recognize the Greek Government Bonds as an investment under subparagraph (b).[3]

It also found that there is a difference between a bond and a loan, which was the type of investment protected under subparagraph (c) and that, in any case, the Greek bonds did not qualify as a claim to money, since Poštová Banka never entered into a contract with the Greek State, but “its contractual relationship . . . was exclusively with the Participants through Poštová Banka”.[4]

In light of these findings, the Arbitral Tribunal found that there was no need to examine whether the bonds would additionally qualify as an investment under article 25 of the ICSID Convention, although the Tribunal indicated that they would similarly fail to do so.

In 2016, the annulment challenge relied on the sole ground of a “failure to state reasons” under Article 52 of the ICSID Convention, but failed to convince the ad hoc Committee.[5]

Even though the Private Sector Involvement Agreement was not discussed per se, the two awards were generally received as strengthening its legality, even more so after the European Court of Human Rights judgment in the case of Mamatas and Others v. Greece (available here), which made similar findings.

In conclusion, the case of Poštová Banka highlights the importance of investment arbitration for the resolution of disputes relating to sovereign debt crisis between States and foreign investors.

While the Poštová Banka decision is non-binding on future arbitral tribunals, international arbitration and Greek sovereign debt issues have been resolved in Greece’s favor, so it seems less likely that additional investors will bring similar disputes in the future.

[1] Poštová banka, a.s. and ISTROKAPITAL SE v. Hellenic Republic, ICSID Case No. ARB/13/8, Final Award of 9 April 2015, available at https://www.italaw.com/sites/default/files/case-documents/italaw4238.pdf.

[2] Ibid at paras. 287-88.

[3] Ibid at paras. 333-34.

[4] Ibid at paras. 337-50.

[5] Poštová banka, a.s. and ISTROKAPITAL SE v. Hellenic Republic, ICSID Case No. ARB/13/8, Decision on Annulment of 29 September 2016, available at https://www.italaw.com/sites/default/files/case-documents/italaw7587.pdf.