Among the principles ensuring the protection of foreign investments, bilateral investment treaties (“BITs”) typically include the free transfer principle regarding the transfer of funds/returns of the investments into and out of the host State of investment. One of the primary objectives of BITs is to provide a stable and predictable legal framework that boosts the […]

Bilateral Investment Treaty

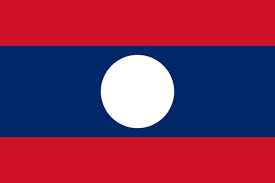

Proving Corruption in Investment Arbitration – Lao Holdings v. The Lao People’s Democratic Republic

Defenses based on alleged corruption-related activities by investors have become popular by States in investment arbitration. Given the seriousness of such accusations, one of the most important tasks for arbitral tribunals is undoubtedly to sort out legitimate defenses based on well-established facts of corruption from unfounded insinuations. Therefore, the approach undertaken by arbitral tribunals regarding […]

Interest in International Investment Arbitration

In international investment arbitration interest may represent a significant portion of a final award and it is not uncommon for interest to exceed actual damages.[1] While not being an independent remedy, interest represents an important element of compensation.[2] The main purpose of an award of interest is “to compensate the damage resulting from the fact that, […]

Arbitragem CIRDI: o que é uma disputa de investimento estrangeiro?

Uma disputa de investimento estrangeiro é aquela entre um investidor originário de um determinado país e o governo de um país diverso relacionada a um investimento no país hospedeiro/receptor. Muito embora este assunto pareça simples, existem diversas questões bastante complexas. Uma questão importante é aquela sobre do quê se trata um investimento. A partir do […]

William Kirtley and Marina Sim Comment on Taxes and Investment Arbitration

William Kirtley and Marina Sim were interviewed by LexisNexis to discuss the judgment of the Paris Court of Appeal in Vincent J. Ryan, Schooner Capital LLC, and Atlantic Investment Partners LLC v Republic of Poland, and the claimants’ set-aside application and its implications for investment treaty arbitration (ITA) practitioners. The dispute concerned States’ authority to […]

Discriminatory, Unreasonable and/or Arbitrary Measures in Investment Arbitration

The prohibition of discriminatory, unreasonable and/or arbitrary measures affecting investors’ investments normally figures among the protection standards provided by bilateral or multilateral investment treaties. Although it is considered as an independent basis for a finding of State responsibility, some arbitral tribunals have considered that the standard of protection against arbitrariness or discrimination is closely linked […]

Intra-EU Investment Arbitration: Impact of EU Member States’ Declarations in the Wake of Achmea

In Achmea,[1] the Court of Justice of the European Union (CJEU) was asked to assess the compatibility of the dispute resolution clause contained in the Netherlands-Slovak Republic BIT with EU law. In March 2018, the CJEU held that the clause was incompatible based on the threat posed to the constitutional structure and autonomy of the […]

Time Limitations and Stale Claims in Investment Arbitration

Investment arbitration sometimes deals with legal issues that are particularly well-rooted in national laws, whereas their application at the international level is less evident. One of these issues revolves around the concept of time limitations. In fact, host States of investment might build their defence based on this concept, arguing that investors’ claims are stale, […]

Fork in the Road Provision in Investment Arbitration

The fork in the road provision, or Electa una via, non datur recursus ad alteram (English translation: “when one way has been chosen, no recourse is given to another”[1]), belongs to a category of jurisdiction-declining provisions[2] marking “the relationship between international arbitration and adjudication by domestic courts.”[3] However, it should be noted that certain tribunals have […]