Among the principles ensuring the protection of foreign investments, bilateral investment treaties (“BITs”) typically include the free transfer principle regarding the transfer of funds/returns of the investments into and out of the host State of investment. One of the primary objectives of BITs is to provide a stable and predictable legal framework that boosts the […]

Investment Arbitration

Renewable Energy Arbitration

Climate change is one of the most concerning phenomena in today’s world. One of the tools almost every country is using to combat global warming is to incentivize the use of renewable energy sources, as opposed to the use of fossil fuels. Humanity has relied on fossil fuels without taking into consideration the long-term consequences. […]

Climate Law in Investment Arbitration – Two Sides of the Same Coin

The role of climate law in investment arbitration is a problematic issue. Even though environmental consciousness and sustainability are increasingly important in today’s world, and investment arbitration tribunals have also recently recognized the importance of adjusting investment law to support the goals of climate law, there seems to exist a clash between the two fields […]

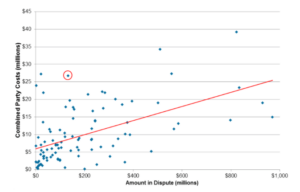

Assessing and Forecasting Costs in Investment Arbitration

Many variables can influence the costs of investment arbitration. While the costs of parties’ counsel and the arbitral tribunal’s fees are far from trivial, other potential variables may be useful to assess and forecast the costs of investment arbitration disputes. In this post, we will explore how some variables may impact the parties’ overall costs […]

Denial of Benefits in Investment Arbitration

Many of the Multilateral and Bilateral Investment Treaties (BITs) concluded in recent decades contain a provision often referred to as a denial of benefits clause. Examples include the Netherlands Model BIT[1], the Comprehensive Economic and Trade Agreement between Canada and Europe (CETA)[2] and most notably the Energy Charter Treaty (ECT).[3] The aim of denial of […]

Customary International Law and Investment Arbitration

Customary international law plays a significant role in investment arbitration disputes. Parties frequently rely on customary international law as a secondary source of law under a bilateral investment treaty (BIT) or a State contract. In some cases, arbitral tribunals have accepted a more prominent role of customary law, i.e., as a self-standing source of international […]

Umbrella Clauses in Investment Arbitration

In investment arbitration, an umbrella clause can constitute an advantage for investors, protecting investments by placing obligations entered into by a host State of investment under the protective “umbrella” of an international treaty. By linking the violation of local law to the violation of a Bilateral Investment Treaty (“BIT”), contract claims may in particular be […]

Expropriation in Investment Arbitration

Expropriation in investment arbitration concerns two notions: (1) each State’s right to exercise sovereignty over its territory and (2) each State’s obligation to respect properties belonging to foreigners. The first means that a State may, in special circumstances, expropriate a foreign investor’s property. The second means that the expropriation of foreign-held properties will only be […]

Fair and Equitable Treatment in Investment Arbitration

Fair and equitable treatment is a prominent standard of protection in investment arbitration disputes, which is present in most bilateral investment treaties (“BITs”).[1] The standard has evolved in post-World War II treaties. The 1948 Havana Charter for an International Trade Organization is said to be the first treaty to include “just and equitable treatment” for […]