Aceris Law is co-sponsoring an international arbitration conference with Hogan Lovells, Dechert, White & Case and Dentons, to be held on 2 June 2017 at the Centre Panthéon in Paris, France. The conference will be composed of a series of round table discussions including a variety of distinguished speakers in the field of international arbitration. […]

Investment Arbitration

Limits to the Police Powers Doctrine

According to the police powers doctrine, host States may enforce their laws against the foreign investors without being liable of any wrongdoing. For example, a host State may revoke a concession granted to an investor if the latter does not comply with laws of the former. The tribunal in Quiborax v. Bolivia agreed with the […]

Valeri Belokon v. Kyrgyz Republic – Money Laundering in Investment Arbitration

On 14 October 2014, an UNCITRAL arbitral tribunal in the case Valeri Belokon v. Kyrgyz Republic, whose composition included Kaj Hober, Niels Schiersing and Jan Paulsson as President, found Kyrgyzstan liable for the unlawful expropriation of Claimant’s investment. The investment claim had been brought in 2011 by Valeri Belokon, a Latvian investor, against the Kyrgyz […]

Duty to Disclose Third Party Funding in International Arbitration

Is there a duty to disclose third party funding in international arbitration? In the resolution of disputes through international arbitration, whether it involves cases of Investment or Commercial Arbitration, parties increasingly resort to so-called “third party funding” (“TPF”). TPF provides prospective parties to a dispute with the ability to request financing from other entities to […]

European Court of Human Right Judgement Ruled Unenforceable in Russia – Consequences for Yukos Investment Arbitration Awards

On 19 January 2017, Russia’s Constitutional Court ruled that the State was not under an obligation to comply with the European Court of Human Rights (“ECtHR”) Judgement in the Yukos Case, which awarded approximately EUR 1.9 billion in compensation to the company (the largest in the ECtHR’s history), because of Russia’s breach of the European […]

From International Investment Arbitration to an Investment Court System

Will an Investment Court System be better than the current arrangements for International Investment Arbitration? The EU and Canada appear to think so. In the recently-approved and signed Comprehensive Economic and Trade Agreement between the European Union (EU) and Canada, a different approach to International Investment Arbitration is being put forward by the EU and […]

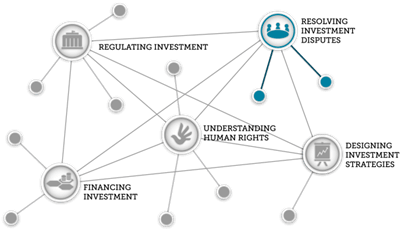

Human Rights and Investment Arbitration: Parallel Proceedings

Human rights and investment arbitration are not opposed, and in fact there is a considerable degree of overlap. The European Court of Human Rights (‘ECtHR’) has been used as an alternative forum or supplement to Investment arbitration in multiple disputes. Even though the ECtHR and Investor-State Arbitral tribunals belong to prima facie different regimes, and […]

Investment Arbitration Award Enforcement – Yukos Saga Continues

Investment arbitration award enforcement can at times be difficult due to issues such as sovereign immunity, but November 2016 has proven to be an especially difficult month for the Yukos Awards enforcement saga. First, the Financial Times revealed Rosneft emails to Armenian judicial authorities, which suggested that Rosneft may have had a hand in manipulating […]

Reconsideration in Investment Arbitration

Reconsideration in investment arbitration is an exception to the rule that awards are final and binding on the parties to a dispute. There are four explicit remedies available for awards rendered under article 48 of the ICSID Convention. Parties can only bring their challenge under the ICSID Convention. First, a party can request a supplementary […]