Arbitration is only possible when both the claimant and the respondent have consented to it. In Investment Treaty Arbitration specifically, an investor can “perfect consent” by accepting an offer to arbitrate in an investment treaty. This article explores the significance of ICSID Denunciation in light of Fábrica de Vidrios Los Andes, C.A. & Owens-Illinois de Venezuela, C.A. […]

Investment Arbitration

Arbitragem em Angola e Moçambique

A arbitragem no continente africano tem se desenvolvido nitidamente. Angola e Moçambique são exemplos de que o instituto tem se firmado como um dos meios preferidos de resolução de conflitos. Angola O ano de 2017 foi particularmente importante para Angola. Após décadas de inseguranças, o país finalmente aderiu à Convenção de Nova York, ratificada pela […]

Damages in Investment Arbitration

The recovery of damages in investment arbitration is a multi-layered and complex issue. You do not need to be an expert, however, to understand the most important concepts. Introduction and Basic Principles The root of all claims for damages under public international law is the Chorzów case. In it, the Permanent Court of International Justice (the predecessor […]

State Counterclaim in Investment Arbitration

An ICSID arbitral tribunal awarded approximately USD 40 million in damages to Ecuador for the foreign investor’s liability for the costs of restoring the environment in an area concerned by the investment. This award of a counterclaim in investment arbitration was made by an arbitral tribunal composed of Gabrielle Kaufmann-Kohler, Brigitte Stern and Stephen Drymer in […]

Brazil and the Cooperation and Facilitation Investment Agreement (CFIA): A Step Backwards for Arbitration?

In 2015, as a result of the increase of Brazilian investment overseas, the Brazilian government, in consultation with private entities, elaborated so-called Cooperation and Facilitation Investment Agreements (“CFIA”s – or “ACFI” in its Portuguese acronym). The CFIA’s aim was to facilitate and stimulate reciprocal investments between States, especially in strategic sectors, much like the Bilateral […]

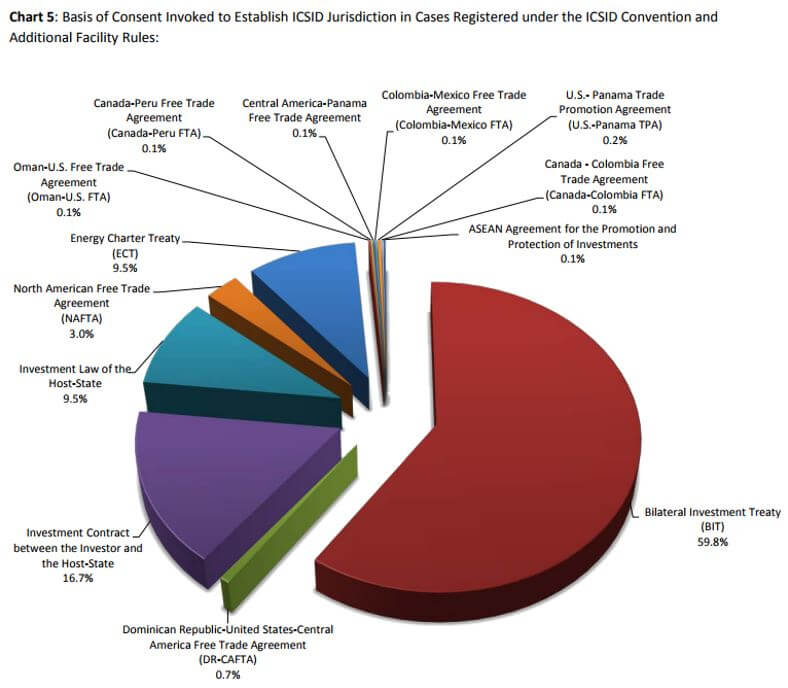

Consent in Investment Arbitration

Investment arbitration, like any arbitration, is a creature of contract. A party submitting a case to the International Centre for Settlement of Investment Disputes (the “Centre”) therefore must ensure that their adversaries have consented to arbitrate. This article answers the ‘what, how, and when’ of consent in investment arbitration. What is “Consent”? Article 25(1) of […]

Obtaining Third-Party Funding for International Arbitration – How It Works

Obtaining third-party funding for international arbitration is not an easy process. Aceris Law LLC has already written about the issue here. When searching for third-party funding, prospective litigants often lack information on the requirements and knowledge of what is required to successfully fund an arbitration. By composing the following list, we hope to demystify the […]

Disclosure of Third-Party Funding in International Arbitration

The disclosure of third-party funding is becoming increasingly common in international arbitration proceedings. This is reasonable, as the fact that there is an outside influence on the case affects the decision-making process and impacts issues such as transparency, impartiality, independence and conflicts of interest. For instance, if a third-party funder has a conflict of interest […]

The Cost of Investment Arbitration: UNCITRAL, ICSID Proceedings and Third-Party Funding

Party Costs in Investment Arbitration In a recent article by Global Arbitration Review, the second edition of a recent empirical study reveals that the cost of investment arbitration is unfortunately on the rise yet again. Since 2013, average party costs were a massive USD 7.41 million for claimants and USD 5.19 million for respondents. Before then, […]