The simplest investment protections to understand, as well as the widest, are usually provided in Bilateral Investment Treaties (“BIT’s”). Protection via BIT’s is not granted to every foreign entity that is impacted by the measures of a host State of investment, however. In order to enjoy protection under BIT’s, business actors must qualify as investors […]

Investment Arbitration

Valuation Date of Expropriated Investment in Investor-State Arbitration

The valuation date of an expropriated investment represents a crucial factor in assessing the amount of compensation to be paid in investor-State arbitrations, as the value of investments may change dramatically over the course of time. Arbitral tribunals are keenly aware that the value of investments change over time. For example, the Iran-US Claims Tribunal […]

The Salini Test in ICSID Arbitration

Article 25(1) of the ICSID Convention states that “[t]he jurisdiction of the Centre shall extend to any legal dispute arising directly out of an investment”. The manner in which tribunals have applied this provision has gradually evolved and has been subject to considerable debate. The Salini Test has been at the heart of this debate. […]

How Do Investment Arbitration Tribunals Interpret Investment Treaties?

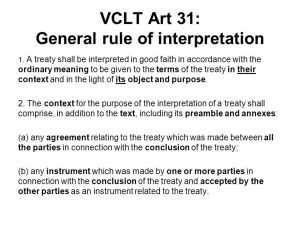

When interpreting a treaty provision, arbitral tribunals should first and foremost look at the “ordinary meaning of the terms”. This methodology is prescribed by Article 31 of the 1969 Vienna Convention on the law of treaties (VCLT). VCLT Articles 31-32 are codifications of customary international law. The interpretative approach prescribed by these articles should be […]

Duty to Mitigate Damages in Investment Arbitration

Notion of the Duty to Mitigate Damages Along with contributory negligence, a duty to mitigate damages is considered as a “compensation-reducing”[1] factor. However, contrary to contributory negligence, the duty to mitigate damages arises only after the breach of an international obligation. It implies an obligation for an aggrieved party to “take steps to minimize his loss, on […]

Contributory Negligence in Investment Arbitration

Contributory negligence in investment arbitration (also known as “contributory fault”) corresponds to situations where an injured party has materially contributed, by a negligent (or wilful) act or omission, to the damage caused by an internationally wrongful act of a State. The contribution of the injured party is, therefore, taken into consideration by arbitral tribunals in […]

Vodafone versus India Investment Treaty Arbitration

The Vodafone versus India investment treaty arbitratoin has its origins in 2007 when Vodafone acquired a majority stake in India’s Hutchison Essar[1]. It was a Cayman island transaction. Essentially, Vodafone used the tax haven to escape the jurisdiction of India’s tax authorities. Retroactive Taxation It was therefore unsurprising when, in 2012, the Indian Supreme Court […]

Enforcing an Investment Arbitration Award: When States Refuse to Pay

Enforcing an investment arbitration award against a sovereign State is not easy. It is particularly hard when that State firmly refuses to pay after losing an arbitration. Such a situation is obviously problematic for an investor. An investor must spend considerable resources, usually in the realm of millions of dollars, prior to receiving a favorable […]

Arbitration Disputes in the Banking Sector: Sudden Changes of Legal Frameworks

A sudden change of the banking sector legal framework has provoked a tide of arbitrations against South-Eastern European States. Interventionist measures enacted by host States of investment have harmed the position of foreign banks on the local market. Consequently, banks have decided to initiate arbitral proceedings to protect their interests. Countries in South-Eastern Europe have […]